Townships

Home »

Hand County Townships

Alden, Alpha, Bates, Burdette, Campbell, Carlton, Cedar, Como, Fairview, Florence, Gilbert, Glendale, Grand, Greenleaf, Harrison*, Hiland, Holden, Howell, Hulbert, Linn, Logan, Midland, Miller, Mondamin, Ohio, Ontario, Park, Pearl, Plato, Pleasant Valley, Ree Heights, Riverside, Rock Dale, Rose Hill, Saint Lawrence, Spring, Spring Hill, Spring Lake, Wheaton, York.

Townships with * denote current unorganized townships.

Welcome to the Hand County Township page, hosted by the Hand County Auditor’s Office and the Director of Equalization.

You may “skip” to a specific page by following these links:

- The 4th Annual Township Workshop will not happen this year, so we’ll try again in 2027.

- 3rd Annual Township Workshop will be held on February 12, 2025, in the Hand County Courtroom. 1:00 P.M.

- 2nd Annual Township Workshop was held on February 26, 2024, in the Hand County Courtroom.

- The video of the two-hour meeting is found on the Auditor’s YouTube page or at this Video link.

Township Meetings

- If you are a township clerk, click this link to go to “your page“. Here you fill find the documents you need for the upcoming meetings in February and the Annual Meeting on March 5th.

- If you are the township treasurer, click this link to go to “your page“. Here you fill find the worksheets for completing your financial reports. Please note the forms are those prescribed by the South Dakota Department of Legislative Audit.

Legal Notices published by the county for the townships

- Township Legal Notices

- If a township wants us to also post their legal notices, you will need to email them to d.deboer@handcountysd.gov at least a week prior to whatever is listed in your legal notice.

Example (from another SD County) of the “legal notice” for when your annual meeting & equalization meeting are to be held:

NOTICE OF ANNUAL MEETING AND LOCAL BOARD OF REVIEW (SDCL 10-11-13)

NOTICE IS HEREBY GIVEN that the citizens of ___________ Township in the County of Hand, South Dakota and who are qualified to vote at the Township elections, are hereby notified that the Annual Township Meeting for said Township will be held at the _______________________________ , ______________, SD in said township on Tuesday, the day of March, 20 at (A.M. or P.M.) for the following purposes: To elect one supervisor for the term of three years, one treasurer, one clerk, each for a 1 year term; and to conduct any other business brought before the meeting. In case of inclement weather, this meeting will be rescheduled for the following Tuesday at the same time and location.

Given under my hand this day of February ___, ________ . _______, _____________ Township Clerk.

Please publish the week of February ______ and February _______, 20_____.

NOTICE IS FURTHER GIVEN that the governing body, sitting as the Review Board of ______________ Township, Hand County, South Dakota will meet at the in said township on Monday, March , 20 at (A.M. or P.M.) for the purpose of reviewing and correcting the assessment of said township for the year 20 . All persons considering themselves aggrieved by said assessment are required to notify the clerk of the local board no later than March , 20 . In case of inclement weather, this meeting will be rescheduled for the following Tuesday at the same time and location.

Given under my hand this day of February ___, ________ . _______, _____________ Township Clerk.

Please publish the week of February ______ and February _______, 20_____.

Laws that Govern townships in South Dakota

- South Dakota Legislative Research Council Title 8

Contacting the county:

Director of Equalization / Assessor: 605-853-2115 or j.russell@handcountysd.gov

Auditor: 605-853-2182 or d.deboer@handcountysd.govOffice Text Number (hosted by Google): 605-550-0233

Records Retention for Townships

- What to keep, what can be destroyed and when?

- Click this link to visit the Records Retention and Destruction Schedule published by the Bureau of Administration.

System of Award Management

- Federal website for program management, like FEMA.

- You may be asked to create an “id.me” account. https://sam.gov/

- Digital Wallet, Identity Verification, and More | ID.me

South Dakota Sales and Use Tax

- Townships are exempt from paying sales tax on purchases, but you need to have your exemption certificate.

- Townships are not exempt from paying excise tax.

- Townships that sell things will need to charge sales tax and file a return with the Department of Revenue.

- Townships that perform services may need to charge excise tax and or “use tax”.

- Call: (800) 829-9188 or visit https://dor.sd.gov/ to find out the particulars of how this works.

This may sound complicated but once you get your sales tax exemption certificate, it is as easy as making a phone call. I do it almost every week at the county. They are very helpful.

South Dakota Local Transportation Assistance Program: “The South Dakota Local Transportation Assistance Program (SDLTAP) translates the latest highway and bridge technology into understandable terms for local government entities throughout the state. In linking transportation technology and local government, SDLTAP keeps local government officials informed about new publications, techniques and training opportunities that may benefit their communities.”

Check out their website and give them a call. They might have a solution for your roadway problems.

2023 Planning for 2024

Looking for your EMPLOYER IDENTIFICATION NUMBER (EIN) for the IRS? The SS-4 form is your tool. If your township does not have an EIN you can apply for one using this form. Click Form SS-4 (Rev. December 2019) (irs.gov) to be directed to the form. Read page 2 before completing page 1.

Other places to locate a missing EIN for your township? Your bank or insurance provider.

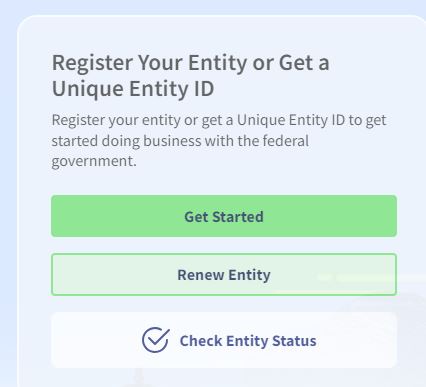

FEMA (Federal Emergency Management Agency) recovery funds will require townships to have a SAM (System for Award Management) profile and number. Visit https://sam.gov/ and press the “Get Started” button.

Assessor Township Board Information

2023 Schedule

- Local Board of Equalization

- March 16 – last day for taxpayer to file written appeal with clerk of local board

- March 20 – local board begins

- March 24 – local board ends

- March 27 – board must return assessment book to Director of Equalization

- April 1 – last day to send written notice of board’s decision to each appellant.

- Township Minutes Form

- 2023 Township letter

RURAL ACCESS INFRASTRUCTURE FUND GRANT

(This data is from the County Highway Department)

ATTENTION ALL TOWNSHIPS: Funding opportunity available

Does you’re Township have small bridges or culverts you need to replace? The South Dakota Legislature created the Rural Access Infrastructure Fund to help townships and counties repair and replace culverts and bridges on township and county secondary roads.

For this particular program Townships need to fill out their own applications individually.

UPDATED AS OF APRIL 2024

RAIF WILL INCLUDE STRUCTURES ON MINIMUM MAINTENANCE ROADS

If you have any SMALL STRUCTURES on MINIMUM MAINTENANCE ROADS please let us know so we can get them on the list of structures in the county.

UPDATES TO THE RURAL ACCESS INFRASTRUCTURE FUND GRANT: SB124 has made it permissible to use RAIF Funds on culverts and small bridges on Minimum Maintenance Roads.

If you would like to apply for funds for any structures on minimum maintenance roads please let us know so we can get the process rolling.

Join AlertSense

Click here and sign up to receive public safety alerts and severe weather warnings.

County Calendar

Click here and stay connected with what’s happening in Hand County.